I hope you find this article insightful. If you’re looking for expert guidance on property investments in Dubai, feel free to reach out.

Author: Fahad Al Kuwari | Dubai Real Estate Consultant

Click here to get in touch with me directly.

In the dynamic Dubai real estate market, the debate between Off-Plan vs. Ready Properties is crucial for investors in 2025. Choosing the right property type can greatly impact investment outcomes, as both options offer distinct opportunities and challenges.

Whether you’re an experienced investor looking to expand your portfolio or a first-time buyer seeking entry into Dubai’s growing market, understanding the pros and cons of off-plan vs. ready properties is essential.

Off-plan properties offer the potential for capital appreciation, flexible payment plans, and lower entry costs. On the other hand, ready properties provide immediate rental income, market stability, and the security of a tangible asset.

With 2024 poised to be a pivotal year for Dubai’s real estate market, this comprehensive guide will help you make an informed decision by exploring market trends, investment potential, legal considerations, and real-life examples.

Key Takeaway: Whether you choose off-plan or ready properties, aligning your decision with your investment goals, risk tolerance, and the current market trends in Dubai will be the key to maximizing returns.

- What Are Off-Plan Properties in Dubai?

- What Are Ready Properties in Dubai?

- Comparing Key Factors: Off-Plan vs. Ready Properties

- The Price Paradox: Off-Plan vs. Ready Properties in Dubai

- Off-Plan Properties and Capital Appreciation: A Guarantee or a Gamble?

- Which is Better: Off-Plan Payment Plans or Ready Property Mortgages?

- Who Should Invest in Off-Plan Properties in Dubai?

- Who Should Invest in Ready Properties in Dubai?

- Legal and Financial Considerations for Off-Plan and Ready Properties

- Buyer Profiles and Case Studies: Off-Plan vs. Ready Properties

- Future Outlook for Off-Plan and Ready Properties in Dubai

- Conclusion: Off-Plan vs. Ready Properties

- FAQ: Off-Plan vs. Ready Properties in Dubai

What Are Off-Plan Properties in Dubai?

Off-plan properties in Dubai refer to properties that are purchased directly from developers before the completion of construction.

These properties are sold based on architectural plans and project outlines, often accompanied by detailed brochures and virtual tours to help buyers visualize the finished product.

Dubai’s off-plan market is particularly robust due to the city’s rapid expansion and the availability of prime real estate in newly developed areas.

Key Benefits of Off-Plan Properties:

Risks Associated with Off-Plan Properties:

Dubai currently has several well-known off-plan developments like Armani Beach Residences in Palm Jumeirah and W Residence in Dubai Harbour, which are attracting significant interest due to their locations, flexible payment plans, and anticipated long-term value appreciation.

For a more detailed look at the process, check out this comprehensive guide to buying off-plan properties.

What Are Ready Properties in Dubai?

Ready properties, also known as completed or move-in-ready properties, are homes that are fully constructed and available for immediate purchase or occupancy.

These properties are typically located in well-established areas with completed infrastructure, offering investors the advantage of certainty—both in terms of market value and immediate usability.

Dubai’s property market includes many popular ready developments, such as Downtown Dubai and Dubai Marina, known for their rental demand and prime locations.

Key Benefits of Ready Properties:

Potential Downsides of Ready Properties:

Investors looking for stable, long-term rental income or those with lower risk tolerance often prefer ready properties. Projects like Downtown Dubai or Dubai Marina provide immediate opportunities for rental income in high-demand areas, making them an attractive option for cash-flow-driven investors.

For those new to the process, this step-by-step guide to buying property can help

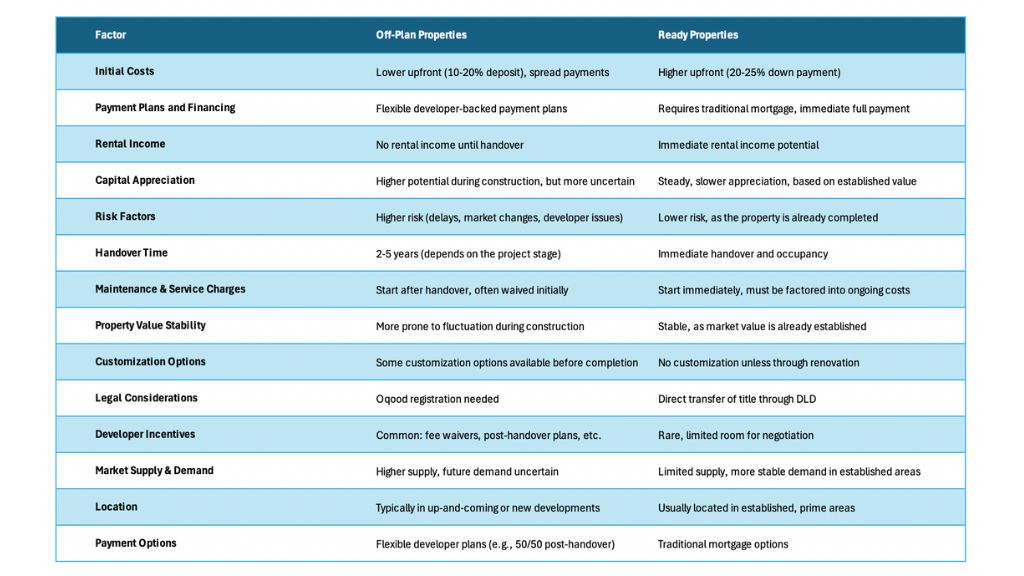

Comparing Key Factors: Off-Plan vs. Ready Properties

Investment Potential: Off-Plan vs. Ready Properties

When it comes to investment potential, both off-plan and ready properties have distinct advantages.

Off-plan properties often provide greater capital appreciation because they are purchased at a lower price point during the pre-construction phase. As construction progresses, property values typically increase, giving early investors a significant return on investment.

In high-growth areas like Dubai Creek Harbour and Dubai Harbour, off-plan properties are projected to see strong appreciation over the next few years, particularly as infrastructure improves and the areas become more established.

For ready properties, the investment potential lies in immediate returns through rental income. Established areas such as Downtown Dubai or Dubai Marina already have high demand for rental properties, ensuring that investors can start generating income right away.

However, the potential for property value growth may be lower in the short term, as these properties are priced based on current market conditions. That said, ready properties still offer stability, making them an ideal choice for investors focused on secure, ongoing cash flow.

Learn more about strategies for maximizing ROI in Dubai real estate here

Risk Factors in Off-Plan and Ready Properties

Off-plan properties carry inherent risks related to the construction process. These risks include delays in handover, developer insolvency, or changes in market conditions that could affect the property’s final value.

For instance, market fluctuations during the construction phase could lower demand or pricing by the time the property is ready for handover.

Furthermore, developers may sometimes modify property layouts or amenities, which could impact the property’s resale value or appeal to future tenants.

Ready properties, on the other hand, offer lower risk because they are fully constructed and can be evaluated before purchase. Investors can inspect the property and review its rental history or market performance to make an informed decision.

However, these properties may come with higher acquisition costs and less room for significant capital appreciation compared to off-plan properties.

Off-Plan Payment Plans vs. Ready Property Mortgages

One of the biggest advantages of off-plan properties is the flexibility in payment plans. Developers often offer favorable payment terms, allowing buyers to make a small down payment (sometimes as low as 10-20%) and spread the remaining balance over several years, even post-handover in some cases.

For investors looking to manage cash flow or enter the market without substantial upfront capital, off-plan developments are an attractive option.

In contrast, ready properties usually require full payment upfront or through mortgage financing. While this provides immediate ownership, it also necessitates larger amounts of capital or securing a mortgage, which could lead to higher monthly payments due to interest.

Additionally, ready properties do not typically offer the same level of payment flexibility as off-plan developments.

Market Trends for Off-Plan and Ready Properties

As of 2024, off-plan properties in emerging areas like Dubai Harbour, Dubai Creek Harbour, and even suburban areas like Jumeirah Village Circle are expected to see increased interest due to the competitive prices and the long-term potential of these locations.

With several infrastructure projects planned for completion by 2025, investors may see early capital appreciation.

Ready properties, particularly in well-established areas, will continue to attract investors seeking rental income and lower-risk investments.

Areas like Downtown Dubai, Business Bay, and Dubai Marina remain popular among renters, which helps secure consistent yields for investors.

As Dubai’s rental demand increases with growing expatriate populations, ready properties in prime locations are expected to remain strong performers.

Key Takeaway: Off-plan properties provide higher potential for appreciation but come with construction and market risks. Ready properties offer immediate returns through rental income with lower risk but often require a higher upfront investment.

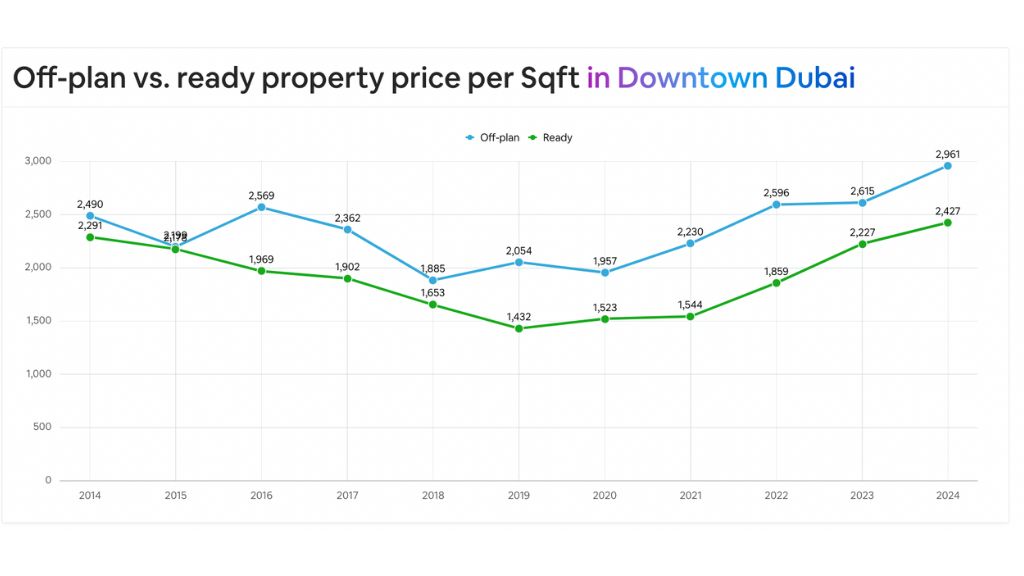

The Price Paradox: Off-Plan vs. Ready Properties in Dubai

In recent years, an emerging trend has seen off-plan properties launched at similar or even higher prices than existing ready properties in the same area. This shift can be attributed to several key factors.

One of the main reasons is the rising construction costs due to inflation and the increasing price of raw materials such as steel and cement. These expenses are passed on to buyers in the form of higher launch prices for new developments.

Additionally, developers often justify these higher prices by offering modern amenities, smart home technology, and superior design compared to older ready properties. These added features make off-plan properties more attractive, even at a premium.

Moreover, the perceived future value and infrastructure development surrounding new projects further push developers to price off-plan units higher, believing that buyers will benefit from long-term appreciation.

Lastly, the flexibility of payment plans allows buyers to spread out the financial burden, making higher prices more palatable despite the delayed returns.

However, investors should be cautious. Buying off-plan at a similar price to ready properties may not always justify the risks involved, such as construction delays or potential market downturns during the project timeline.

These trends are especially significant in the top neighborhoods for long-term growth in Dubai.

Key Takeaway: While off-plan properties may offer modern features and potential for future growth, investors must critically evaluate whether these higher prices provide sufficient value compared to the security and immediate returns of ready properties.

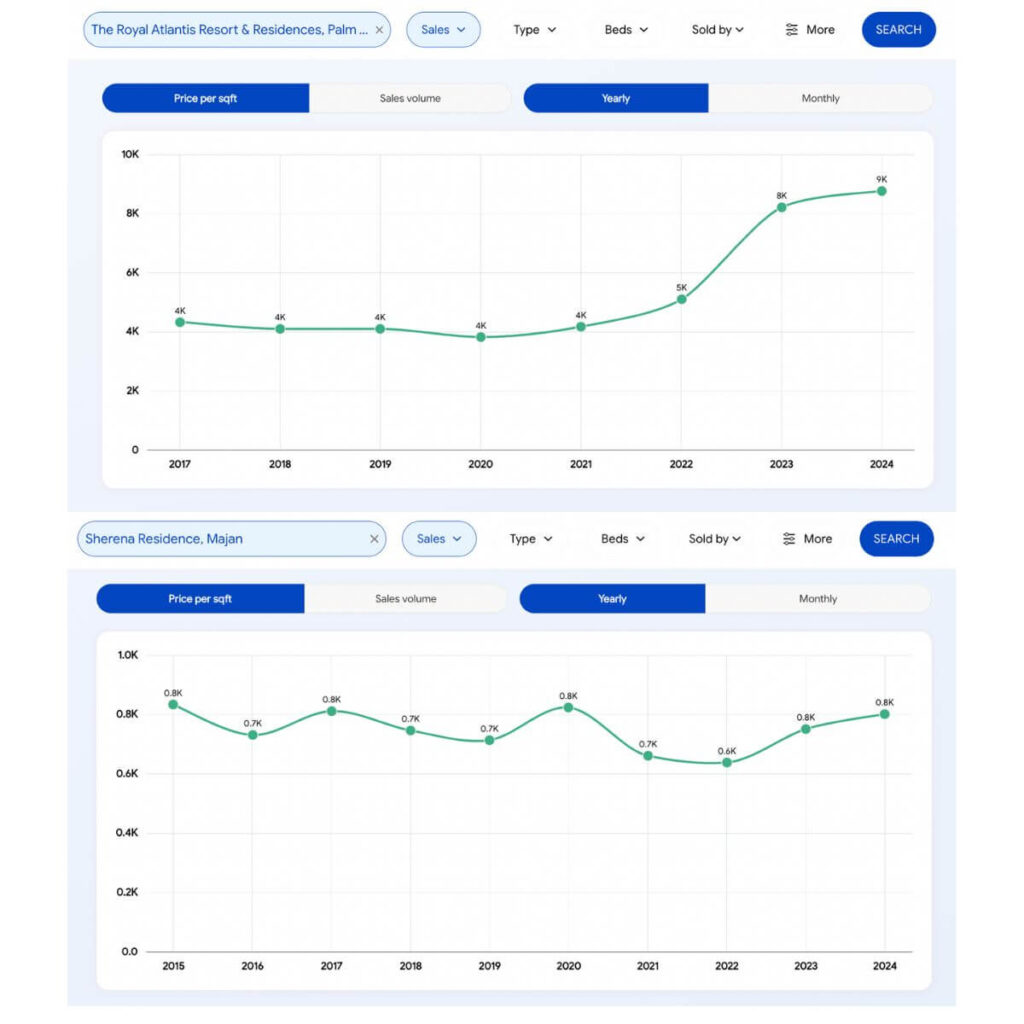

Off-Plan Properties and Capital Appreciation: A Guarantee or a Gamble?

Off-plan properties do not always guarantee capital appreciation. While many investors expect the value of an off-plan property to rise as construction progresses, this outcome depends on several factors:

Key Takeaway: While off-plan properties often have potential for capital appreciation, there is no guarantee, and investors should carefully assess market conditions and project specifics before committing.

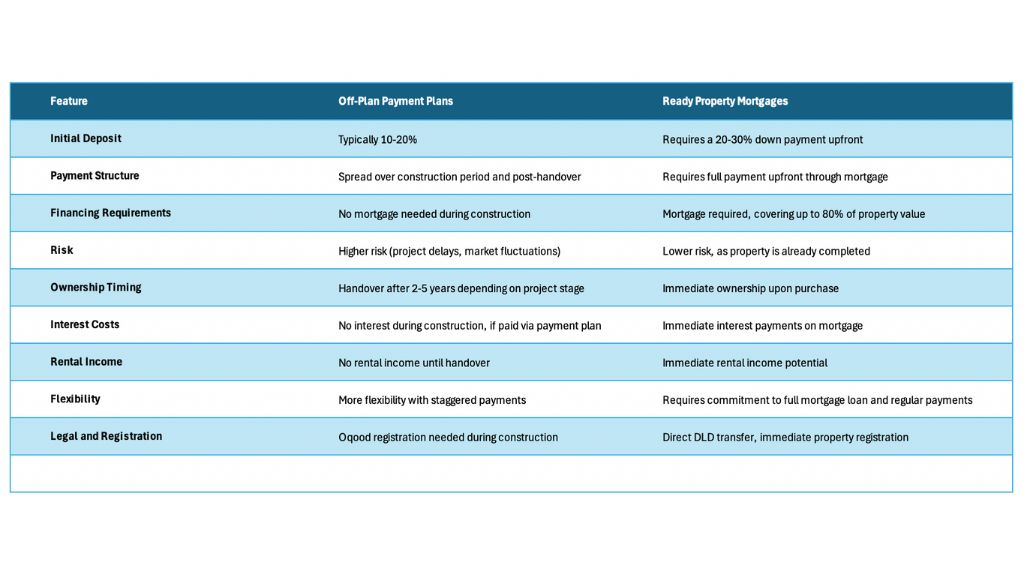

Which is Better: Off-Plan Payment Plans or Ready Property Mortgages?

When investing in Dubai real estate, understanding the difference between off-plan payment plans and mortgages for ready properties is crucial.

Off-Plan Payment Plans offer flexibility, with lower upfront costs and payments spread over several years, often extending beyond project completion. This allows for phased investments but introduces opportunity costs.

Since you’re paying for the property during construction without receiving rental income, you miss out on potential earnings from other investments until the property is handed over. Additionally, there is the risk of delays and market shifts during construction.

Mortgages for Ready Properties provide immediate ownership and rental income. Though mortgages require higher upfront payments (usually a 20-25% down payment), they offer predictability with fixed monthly payments and interest.

This makes them suitable for investors seeking lower risk and immediate returns. The opportunity cost is lower, as you can start generating rental income right after purchase, avoiding the wait associated with off-plan projects.

Which is Better ?

Ultimately, the choice depends on the investor’s financial situation, risk tolerance, and investment timeline. While off-plan offers flexibility, the delayed returns must be weighed against the opportunity cost of capital tied up during construction.

If you’re unsure about payment plans or mortgages, this step-by-step guide to buying property in Dubai can help.

Who Should Invest in Off-Plan Properties in Dubai?

Off-plan properties are best suited for investors who are comfortable with taking on some risk in exchange for potentially higher rewards. These types of properties attract long-term investors who are focused on capital appreciation rather than immediate rental income.

Ideal Investor Profiles for Off-Plan Properties

Example Scenario: Off-Plan Investment

Imagine an international investor purchasing an off-plan unit in W Residence, located in the up-and-coming Dubai Harbour area. With a flexible payment plan, the investor only needs to put down a 10% initial deposit, with the remaining payments spread out over the construction period.

By the time the property is completed, its value may have appreciated significantly, especially if Dubai Harbour undergoes further development during that period.

Long-Term Vision for Off-Plan Investors

Off-plan properties are especially attractive for investors with a long-term vision, such as those who plan to hold the property for several years.

These investors can maximize their returns by selling the property once the area becomes more established or by renting it out for a steady income after the handover.

Who Should Invest in Ready Properties in Dubai?

Ready properties are ideal for investors who are looking for immediate returns and have a lower risk tolerance. These properties are especially appealing for individuals who prefer the security of owning a completed asset that can be rented out or occupied right away.

Ideal Investor Profiles for Ready Properties

Example Scenario: Ready Property Investment

Consider a local investor purchasing a ready unit in Downtown Dubai. The property is immediately available for rent, and the investor can take advantage of the high demand in this prime area to secure tenants.

The rental income begins as soon as the deal closes, providing an instant return on investment. For this investor, the focus is on cash flow stability rather than speculative appreciation.

Lower Risk, Immediate Reward with Ready Properties

Ready properties cater to investors who prefer lower risk and are focused on secure, steady returns rather than waiting for future gains.

The immediate availability of rental income or occupancy makes these properties an attractive option for investors who prioritize stability and certainty.

Legal and Financial Considerations for Off-Plan and Ready Properties

When investing in Dubai, it’s essential to understand the legal and financial obligations for both off-plan and ready properties. These considerations can significantly impact your overall investment decision, especially when it comes to long-term ownership costs, fees, and registration requirements.

Off-Plan Properties: Legal and Financial Considerations

Off-plan properties in Dubai require registration through the Oqood system, which is handled by the developer. This ensures that the buyer’s contract is registered with the Dubai Land Department (DLD). And provides legal protection throughout the construction phase.

The process involves fees for registration, which usually amount to 4% of the property’s purchase price. It’s essential to ensure that the developer is reputable and that the project complies with all regulatory requirements.

Buyers should also be aware of possible delays in receiving the title deed after the handover. This only happens once the project is completed and fully registered with the DLD.

Additionally, the payment plan structure for off-plan properties often extends beyond completion. Some developers offer post-handover payment plans. This allow buyers to spread the cost over several years, reducing the immediate financial burden.

Ready Properties: Legal and Financial Considerations

Purchasing a ready property involves transferring the title deed directly to the buyer. Typically through a transfer process at the Dubai Land Department.

Ready properties tend to involve higher upfront costs, including the full payment. Or mortgage financing, which requires larger capital compared to off-plan properties. However, buyers benefit from legal certainty as the property is already constructed and ready for occupancy.

For ready properties, mortgage financing is readily available. Making it easier for buyers to leverage bank loans to fund their purchases. However, mortgage approval depends on several factors, including the buyer’s credit history, income level, and the bank’s lending criteria.

Additional Costs for Off-Plan and Ready Properties

Both off-plan and ready properties in Dubai come with various service charges, covering maintenance and communal areas. For off-plan properties, these charges typically begin after project completion, while for ready properties, they apply immediately.

One key difference is in brokerage commissions. When buying an off-plan property directly from the developer, there is no brokerage commission for the buyer. As the developer pays it.

For ready properties, however, the typical brokerage commission is 2%, which should be factored into your overall financial planning.

Transfer fees, typically 4% of the property value, are applicable for both types when the title deed is transferred.

Buyer Profiles and Case Studies: Off-Plan vs. Ready Properties

Understanding the types of investors that best suit off-plan and ready properties is essential for making an informed decision. By looking at detailed buyer profiles and case studies. We can explore how different investment goals align with each property type.

Off-Plan Investor Profile Example

Profile:

John is a mid-career international investor with moderate risk tolerance and a focus on long-term capital appreciation. He’s looking to enter the Dubai real estate market at a lower entry price. And is comfortable waiting for returns over the next 5-7 years.

Case Study:

John decides to invest in an off-plan property in W Residence located in the Dubai Harbour area. By taking advantage of the flexible payment plan. He pays 10% upfront and will pay the rest in installments until the project’s completion.

Given the anticipated future growth of Dubai Harbour. John expects the property to appreciate by 15-20% over the next five years.

Since he isn’t in a rush to generate immediate income. The risk of waiting for the property to be completed is outweighed by the potential for capital appreciation.

Ready Property Investor Profile Example

Profile:

Sarah is a Dubai-based investor with a high preference for security and immediate returns. She is looking for properties that can generate rental income right away. And doesn’t want to deal with the uncertainties of construction delays or market fluctuations.

Case Study:

Sarah chooses to invest in a completed unit in Emaar Beachfront. The area has strong demand from expatriates looking for luxury beachfront rentals, which ensures Sarah can secure tenants quickly.

Within a few months of ownership, Sarah begins generating rental income, yielding a solid return.

The property’s prime location means her investment carries less risk. Though there is less opportunity for the rapid capital appreciation seen with off-plan properties. Sarah’s priority is steady, predictable rental income rather than speculative gains.

Comparison of Investor Goals: Off-Plan vs. Ready Properties

Off-plan investors like John are willing to take on higher risks for the potential of greater capital gains. While ready property investors like Sarah prefer stability, immediate returns, and lower risk.

These contrasting profiles show that choosing between off-plan and ready properties depends on the investor’s financial goals, time horizon, and risk tolerance.

Future Outlook for Off-Plan and Ready Properties in Dubai

As we look ahead, both off-plan and ready property segments in Dubai offer distinct opportunities for investors. Shaped by market trends, economic factors, and new developments

Outlook for Off-Plan Properties in Dubai

Off-plan properties are expected to remain popular. Particularly in areas like Dubai Harbour, Dubai Creek Harbour and Dubai South, which are undergoing significant development. With key infrastructure projects nearing completion, these areas are likely to see increased demand, driving appreciation.

The availability of attractive post-handover payment plans makes off-plan properties accessible to a wide range of investors. Regulatory measures, such as the requirement for escrow accounts, help mitigate risks, offering investors more security.

Off-plan properties are anticipated to deliver long-term capital appreciation as Dubai continues its growth as a global city.

Outlook for Ready Properties in Dubai

Ready properties are expected to perform well in established areas such as Downtown Dubai and Dubai Hills. Where demand for rental properties remains strong.

Investors seeking immediate rental income and market stability will continue to be drawn to these areas. Where tenant demand from the growing expatriate population is robust.

With Dubai’s rental market showing resilience, particularly in popular locations, ready properties will offer stable yields for investors. Although capital appreciation may be slower, ready properties remain a solid investment for those prioritizing steady cash flow.

Off-Plan vs. Ready Properties Outlook Summary

Off-plan properties will continue to attract long-term investors looking for significant capital appreciation. While ready properties will appeal to those seeking immediate rental returns and lower risk. The right choice will depend on individual investment goals and market conditions in Dubai.

These neighborhoods are expected to grow in the coming years.

Conclusion: Off-Plan vs. Ready Properties

Choosing between off-plan and ready properties in Dubai comes down to your investment goals, risk tolerance, and financial strategy.

Off-plan properties offer the potential for significant capital appreciation, flexible payment plans, and lower entry costs. Making them ideal for investors with a longer-term view who can manage higher risks.

Meanwhile, ready properties provide immediate returns through rental income, market stability, and the security of owning a tangible, completed asset. Making them an excellent choice for risk-averse investors seeking steady cash flow.

Both segments present opportunities, but the best choice will depend on your individual preferences. Off-plan properties in fast-developing areas like Dubai Creek Harbour may yield substantial future returns. While ready properties in prime locations like Downtown Dubai or Emaar Beachfront ensure immediate income and lower risk.

Ultimately, understanding your investment horizon and financial flexibility will help guide your decision between these two distinct property types in Dubai’s dynamic real estate market.

For more insights, explore our real estate investment guide.

FAQ: Off-Plan vs. Ready Properties in Dubai

Share

Fahad Al Kuwari

Buyer Consultant Dubai Real EstateWith a deep commitment to providing personalized service, I specialize in helping buyers find the perfect property in Dubai. Whether you are looking for a luxurious waterfront villa, a modern penthouse, or a high-yield investment property, I’m here to make the process seamless and enjoyable.